After Someone Pays Using Sumup Where Does The Money Go ?

-

Pros: Piece of cake-to-use menu machines. Low prices and fixed charge per unit. No ongoing costs. Easy sign-up. Online payment features. Business concern account.

-

Cons: POS app may be too simple. No evening helpline. Customer service issues. Limited integrations.

-

Buy if: You need a depression-toll, easy solution for taking card payments in any state of affairs.

All-time cost for Mobile Transaction readers

Get a SumUp Air card reader for only £19 + VAT. No monthly fees or contract. Free delivery in 2-3 working days.

Mobile Transaction is an independent payment industry resource trusted past over a million small businesses per twelvemonth.

We let solution providers to offer production discounts for the benefit of our readers. These discounts practice non influence our editorial content such equally reviews or recommendations. Ratings are based on full retail toll. (Full policy)

How it works

SumUp is a cocky-sufficient payment platform with all the tools you need to take cards hands without contractual obligations. This includes:

-

Menu terminals (choice of 3 models)

-

Payment processing (in person and remote)

-

Online business account with accompanying carte(complimentary)

-

SumUp App (complimentary) and Point of Sale (from £29/mo.)

-

Invoicing software (free)

-

Accounting organisation (still being rolled out)

Y'all just sign upward (takes 5-10 minutes), purchase a SumUp card reader and pay a fixed rate per transaction. At that place are no subconscious fees or fixed monthly costs for any of the features, unless you lot upgrade to the optional Point of Sale app.

Apart from using a carte du jour reader, you can have payments remotely via payment links, an online shop, email invoices and keyed transactions. QR codes can be generated for touch-gratuitous payments in person.

Transactions are processed through the cloud, assuasive real-time admission to sales figures from SumUp App or the spider web-based Dashboard.

The complimentary business business relationship with a Mastercard allows you next-day access to funds, unless you prefer settlement in your bank account.

SumUp rivals Zettle and Foursquare with its depression costs, superb value and ease of getting started.

Accustomed payments and payouts

All the bill of fare readers accept chip (PIN or sign) and contactless NFC payments from any credit or debit card with the Visa, V Pay, Mastercard, Maestro or American Express logo. The mobile wallets Apple tree Pay and Google Pay are accepted besides.

SumUp Air and the 3G Printer terminal too accept Diners Order, UnionPay and Observe, whereas Solo still does not.

The minimum possible payment amount is £1. Customers can tap a contactless card or telephone for amounts upward to £100 without entering a PIN, but the card terminal will crave authentication for amounts above. There's no transaction limit on Apple Pay and Google Pay payments.

What about remote payments? Mastercard, Visa, American Express, Diners Social club, JCB and Discover are accepted online, but not UnionPay.

SumUp initiates payments – minus the transaction fee – to your bank account or SumUp Business Account daily. It takes 1–3 working days to clear in the bank business relationship, whereas the SumUp account receives funds the following 24-hour interval. You can besides choose to be paid weekly or monthly on a schedule.

SumUp App lets you annals cash payments, but non cheques.

SumUp payment terminals

SumUp sells three different bill of fare readers:

-

SumUp Air: Requires Bluetooth connection with app on mobile device

-

SumUp Solo: Palm-sized, mobile touchscreen terminal, works independently

-

SumUp 3G and Printer: Standalone, basic carte du jour reader with fastened receipt printer

They are all wireless and portable, ideal on the go or at a till point when stationed in their corresponding charging dock.

Photo: Emmanuel Charpentier (EC), Mobile Transaction

SumUp Air, Solo and 3G Printer duo.

The cheapest model, SumUp Air, costs just £19 + VAT considering information technology does not piece of work independently. Rather, this wireless reader connects to your smartphone or tablet via Bluetooth, working in tandem with SumUp App to process flake and contactless cards.

SumUp Air is compatible with about Android tablets and smartphones with Android six.0 or college, iPod Touch and iPhone with iOS 10.three or higher, or iPad with iPadOS 10.iii or higher. Bluetooth 4.0 is required to connect it with the mobile device.

The carte reader comes with a micro USB cablevision, which y'all can plug into a computer or power supply when it needs a charge (a wall plug is bought separately).

Photograph: Emily Sorensen (ES), Mobile Transaction

Box contents of our SumUp Air delivery.

You'll become most 500 transactions out of a total accuse. Busy stores may desire to opt for a charging station, which not only keeps the Air charged all day, it as well looks skillful and keeps the reader in identify on a countertop.

The carte reader is smoothen and fashionable with a glass surface and plastic base that's nice to hold in the manus. It's tamper-proof, meaning any external attempt to manipulate its applied science will shut it downwardly so information technology tin't be used any more. That'south peachy for security, but you need to make sure it'due south non near highly magnetic fields, which could inadvertently deem it permanently unusable.

If you demand to impress paper receipts, Air works with compatible receipt printers bachelor at an extra cost. SumUp'south listed options are all mobile Bluetooth printers that connect with the app on your mobile device. A cash drawer tin be linked to it, but but via a receipt printer.

Photo: ES, Mobile Transaction

Scrap card slot and power button of Air.

Photo: ES, Mobile Transaction

Then we take the carte machines that don't require a mobile app: SumUp 3G and Printer and SumUp Solo.

Solo and 3G Printer both have a congenital-in SIM menu with unlimited data, then you don't demand a continued mobile device to procedure card payments. This could exist a handier solution for those who don't need elaborate POS features, but instead adopt one portable device for carte du jour payments or just an extra terminal to use independently from the point of sale.

They have a shorter battery life compared to Air: up to 100 transactions on Solo or 50 transactions on SumUp 3G. We institute that Solo's touchscreen is more ability-hungry, though, when the screen brightness is on maximum.

The SumUp 3G and Printer duo is the cheapest United kingdom carte du jour motorcar that prints receipts at £119 + VAT.

Though information technology works independently, information technology tin all the same connect with SumUp App over Bluetooth. That being said, the 3G reader is intended as a standalone solution and does not connect with any other POS software or equipment. It only works with its SumUp Printer zipper (doubling every bit a charging dock), not other receipt printers.

Photo: EC, Mobile Transaction

The SumUp 3G terminal and printer combo is the cheapest United kingdom carte du jour machine with receipt printer.

SumUp Solo (£79 + VAT) has a well-baked-articulate touchscreen that is more visible in the sun than SumUp 3G's more primitive screen. On the display, you just enter an corporeality, transaction description (optional) and proceed to accept a chip or tap payment.

It has a few more than features than SumUp 3G, like smart tipping and adjustment of screen brightness. Solo is not, however, connected to a product library, cannot take special payment methods similar gift cards, and cannot link to any POS system or receipt printer (or other hardware) like Air is able to.

Photograph: EC, Mobile Transaction

SumUp Solo package contents.

It'due south possible to link several SumUp terminals to your main account, merely you lot cannot link any other brand of bill of fare machine to it.

Fees: low, fixed rate and no monthly charge

No ongoing or monthly fees apply to SumUp – you only pay a apartment rate of 1.69% per card reader transaction, which is lower than Zettle's and Foursquare'south fixed charge per unit. The payment terminals are purchased upfront and endemic by you, just can be returned for a full refund within 30 days if you change your heed.

Given the lack of contractual commitment, termination fees or monthly minimum sales volume, you're not charged anything if you don't make sales for any length of time. This is great for fluctuating sales, seasonal businesses or anyone making £5,000 or less per month in card payments.

| SumUp charges | |

|---|---|

| SumUp card machines | SumUp Air: £xix + VAT SumUp Solo: £79 + VAT SumUp 3G & Printer: £119 + VAT Free shipping and thirty-mean solar day money-dorsum guarantee included |

| Account creation | Gratuitous |

| Contract | No lock-in, no leave fee |

| Monthly cost | Complimentary |

| Card reader transactions | 1.69% (any bill of fare) |

| Refunds | Complimentary before settlement, transaction fee after |

| Chargeback fee | £ten |

| Minimum monthly sales volume | No minimum, no fees |

| Invoice, online & link payments | two.5% per transaction |

| QR lawmaking payments | No transaction fee |

| Virtual terminal & keyed payments | 2.95% + 25p per transaction |

| SumUp charges | |

|---|---|

| SumUp card machines | SumUp Air: £19 + VAT SumUp Solo: £79 + VAT SumUp 3G & Printer: £119 + VAT Free shipping and 30-twenty-four hour period money-back guarantee included |

| Account creation | Complimentary |

| Contract | No lock-in, no get out fee |

| Monthly price | Complimentary |

| Card reader transactions | ane.69% (any menu) |

| Refunds | Free before settlement, transaction fee afterward |

| Chargeback fee | £10 |

| Minimum monthly sales volume | No minimum, no fees |

| Invoice, online & link payments | ii.5% per transaction |

| QR code payments | No transaction fee |

| Virtual terminal & keyed payments | ii.95% + 25p per transaction |

Additional payment methods are electronic mail invoicing, online store payments, and transactions via payment link (SMS, email or social app) or QR code. These are available to everyone in the SumUp account from the starting time.

Keyed and virtual terminal payments are two.95% + 25p per transaction, while online transactions, payment links and electronic mail invoices cost 2.5%. QR code payments are currently complimentary to take, i.e. no transaction fee is charged.

Chargebacks accept a processing cost of £10 each, applicable when a customer disputes a card transaction with their bank.

Refunds are free if processed before the coin is settled in your bank account. After that, yous can only process refunds if there are enough outstanding payouts (coin non yet settled in your business relationship), and SumUp will accuse yous the transaction fee originally paid.

Business Account and Mastercard

Don't have a bank business relationship? Or need faster access to funds in a dedicated online business relationship? The free SumUp Business Business relationship and Card offer an culling mode to go paid the next mean solar day (including weekends) instead of clearing in your bank account.

SumUp Bill of fare (or SumUp Business Mastercard) is a prepaid debit menu linked to your business organization transactions. It can be used in concrete shops, online or for withdrawing cash up to three times a month gratuitous and without monthly fees.

The account is managed in SumUp App or the browser dashboard, where you can:

-

Transfer and receive money to other U.k. banking concern accounts

-

Ready Direct Debits and continuing orders

-

Monitor payouts and transactions

-

Cake your card or alter the PIN

The account and bill of fare features are quite basic and then far. Y'all can, for example, not use information technology for cross-border transfers or more than one account holder.

SumUp App: POS features (and more)

When SumUp first launched in the Britain, the purpose of its app was to link with the carte reader to accept payments in person. It has since matured into something much more than that, covering most payment and business direction features.

Here, nosotros focus on its point of auction features for face-to-face merchants. The app also lets you manage the SumUp Business Business relationship, and access the Virtual Terminal, invoicing, online store functions and customer orders.

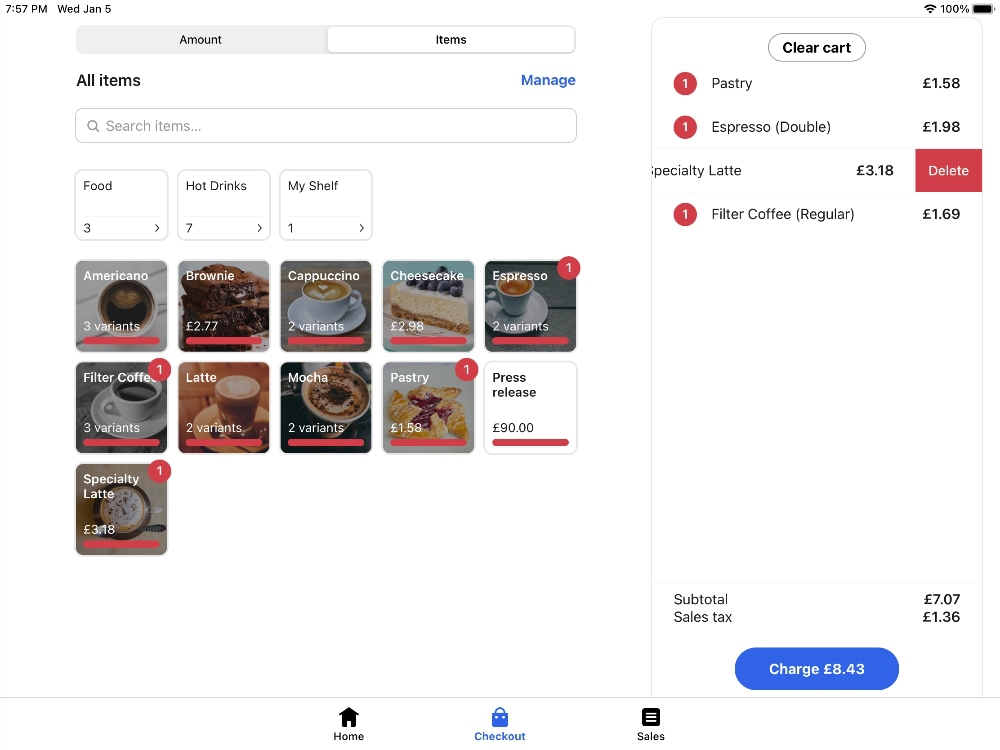

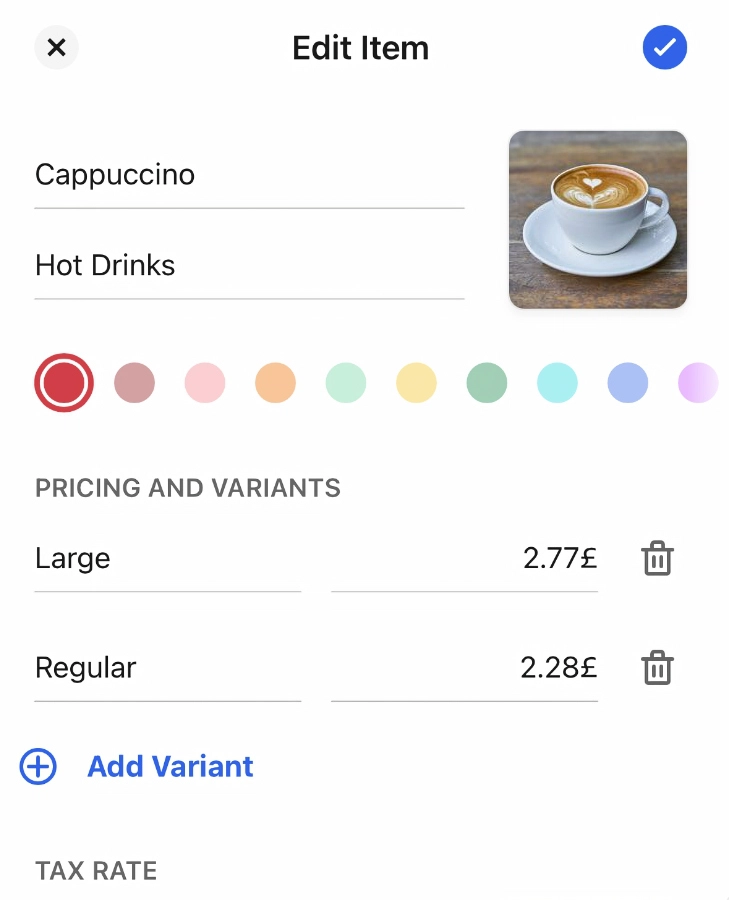

Product library: Unless you adopt to enter a transaction corporeality with optional description, you can add together products with an image, category, tax charge per unit, variants and prices. Items are shown in a checkout menu so you lot can hands tap to add them to the bill.

Image: Mobile Transaction

The product menu is user-friendly on iPad.

You can create different category labels, e.g. "Hot Drinks" and "Food", shown as split tabs on the screen to switch between. However, SumUp does non runway stock levels or allow you lot to add together more than ane level of variants per product.

Image: Mobile Transaction

Add together products with item details.

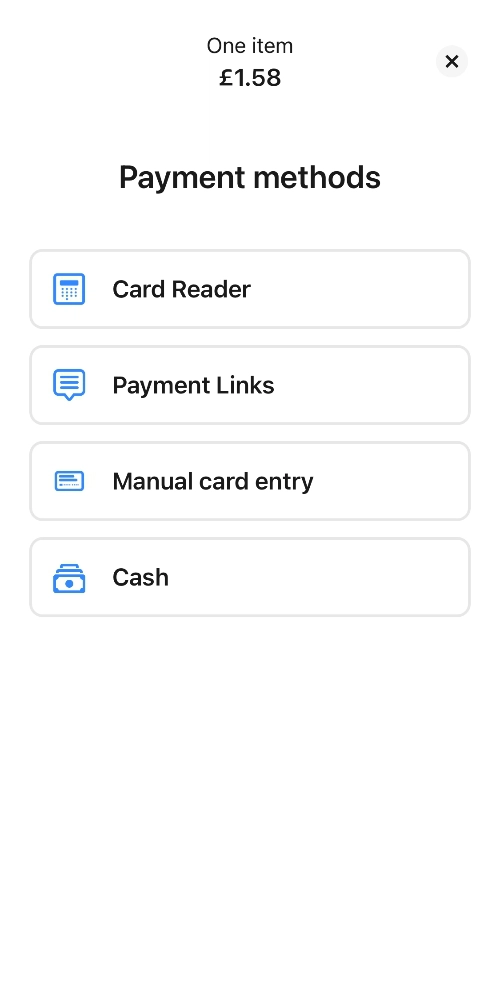

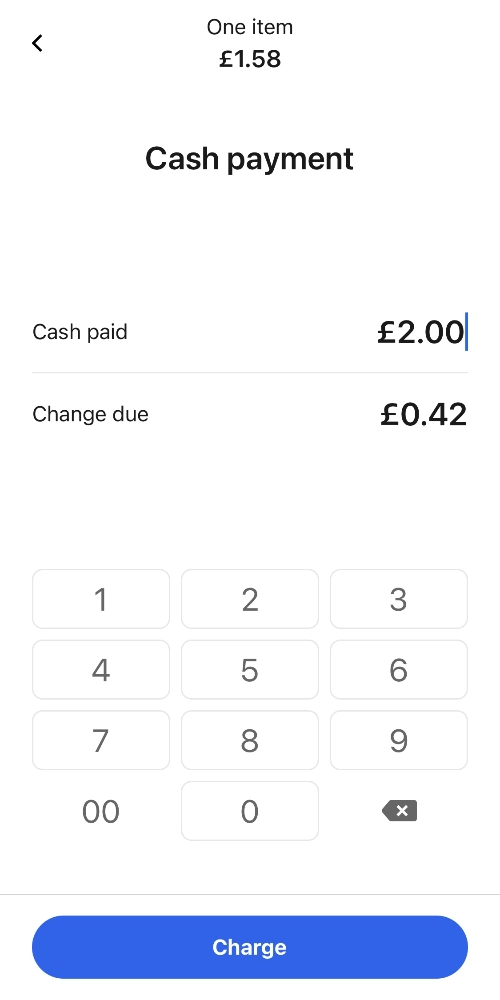

Payment options: Accept cards (via SumUp Air), greenbacks and tips.

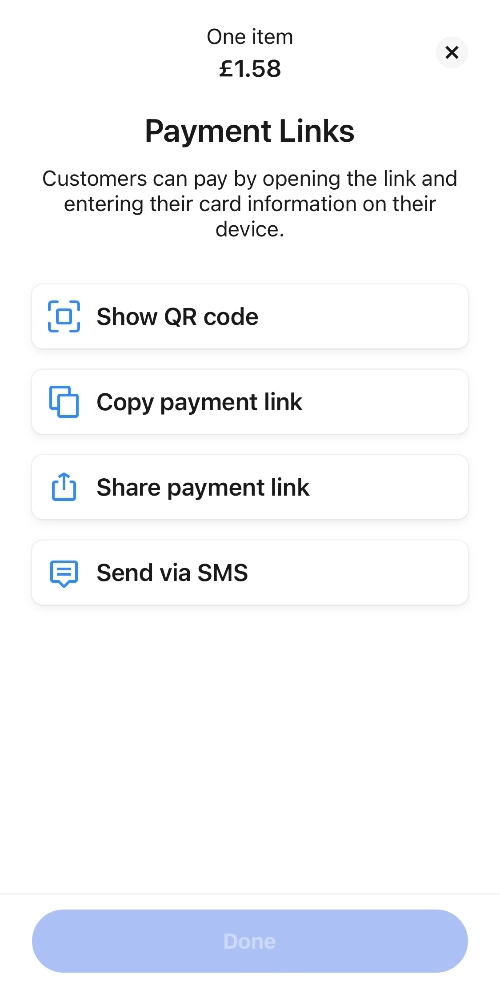

If 'Payment Links' is switched on, y'all besides come across options to send a payment link or text message, or generate a QR code that the client can scan to proceed on their phone – a great way to take payments face to face without a card reader.

Keyed carte entry is displayed for users with a virtual terminal activated.

The app does not take custom vouchers, cheques or other special payment types. You lot cannot take partial payments, splitting between cash and card.

Epitome: Mobile Transaction

Image: Mobile Transaction

Image: Mobile Transaction

You lot can, however, accept SumUp Souvenir Cards. Customers tin can purchase these online from a fixed link y'all share via social media, text, email or messaging app. The customer then receives the virtual souvenir card over electronic mail.

Receipts: Taxes tin exist shown on the receipt, every bit enabled in your settings. After each transaction, you lot tin can send a receipt via e-mail or text or print it. Alternatively, y'all can share it to an app on your – or a nearby – device via the cloud or Bluetooth.

Paradigm: Mobile Transaction

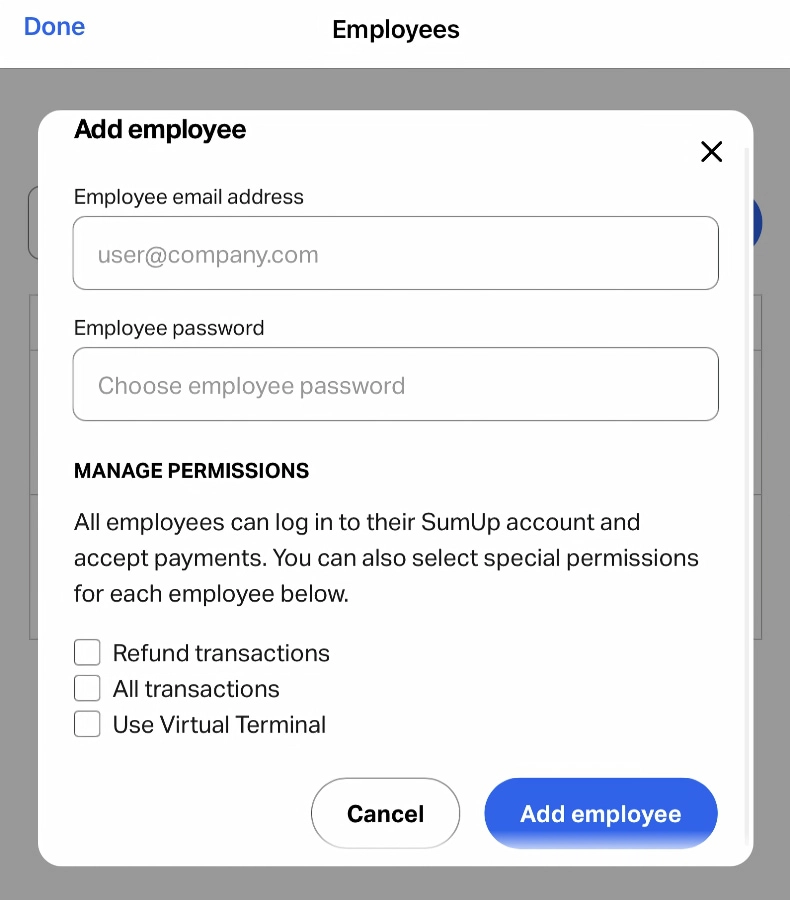

Staff accounts can take refunds and transaction overviews restricted.

Refunds: Refund a consummate or partial transaction corporeality via the original payment method. If the customer paid past card, the refund is processed to that menu. A refund tin only process if in that location is enough remainder, i.e. outstanding payouts currently underway to your bank account, to fund information technology.

Reports and analytics: View a list of transactions and payouts, and filter these according to a time catamenia.

Staff accounts: Create multiple staff logins with bones restrictions, including whether they can view all transactions, process refunds or utilize the virtual last (if activated).

In the browser dashboard, you can sort transactions according to users to monitor sales activities.

POS integrations

Merchants tin can upgrade to a more extensive, just yet easy, POS system called SumUp Indicate of Sale (previously Goodtill).

This is a modular POS system allowing you to add the features relevant to your manufacture, such every bit restaurant, customer loyalty and online ordering features. The basic POS software costs £29 per month, with additional modules added to the price.

A few external POS systems are as well compatible with SumUp Air, such every bit Loyverse and Vend.

Consequently, you shouldn't be afraid to start with the really simple SumUp App if all you want is to receive payments now, but later conceptualize growth.

Online payments: plenty of simple options

SumUp has come a long mode in terms of remote payments since before the Covid pandemic – and these tools are included costless in your account.

For a first, Payment Links allows you to create a transaction in the SumUp App, then choose i of the following:

-

Send a payment link via text or app

-

Copy a payment link to insert into whatever other bulletin on your mobile device

-

Bear witness a QR lawmaking for a touch-free payment confront to face

Food and potable businesses volition benefit from SumUp's multi-use QR codes for individual items to impress and brandish at tables, the counter or in the window. This allows customers to scan the code with their phone and place an gild without staff interaction.

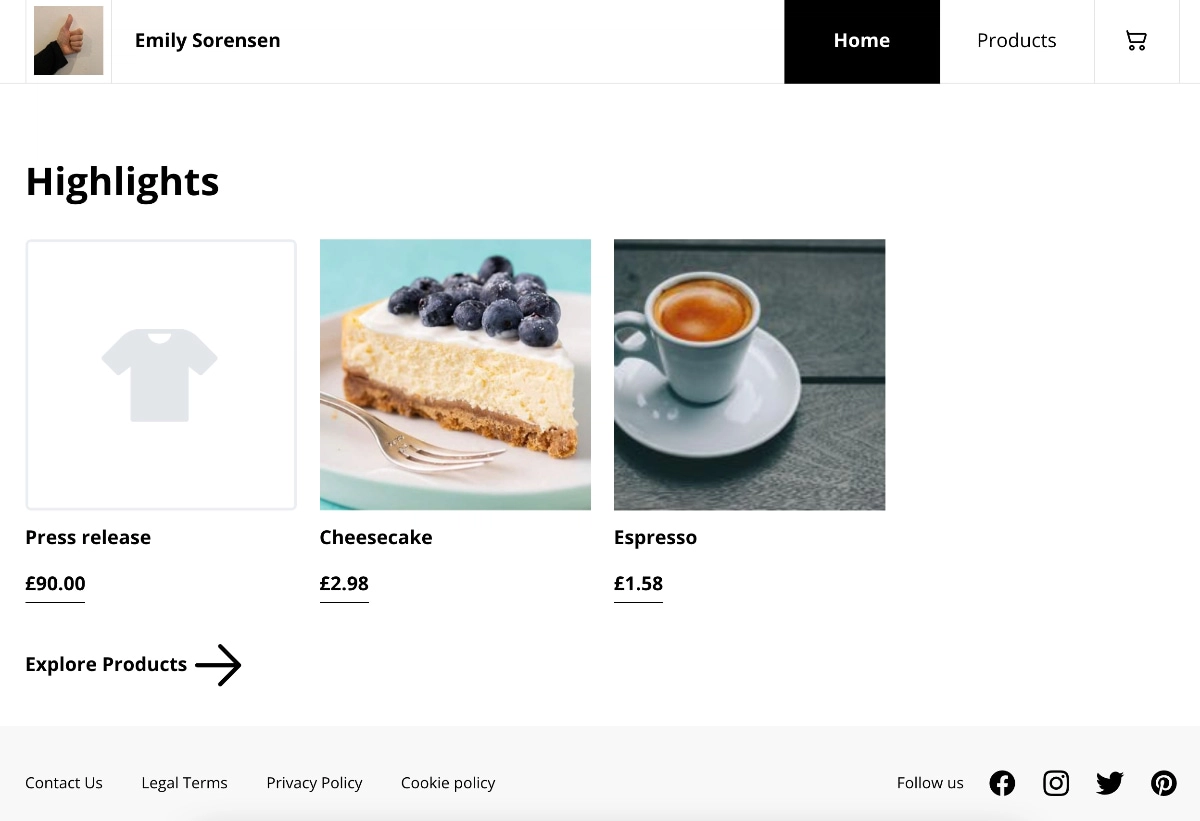

Click-and-collect and delivery orders can be placed online through the very bones SumUp Online Store. It lets you create a uncomplicated spider web folio (through the app, no less!) with products, collection and delivery options. Order notifications are sent and then you tin can prepare shipments or collections promptly. It'southward non a perfect system, merely it does the minimum needed to manage orders from your phone.

Image: Mobile Transaction

An online store through SumUp is extremely bones, but gratuitous, and lets you sell online hands.

The website is, however, extremely basic. At that place are not many editing options and practically no style choices, so it's nil like ecommerce platforms such as Squarespace and Shopify. Instead, yous can edit basics like terms and conditions and collection hours, and you become a free page to share on social media to continue sales afloat while you're non trading in person.

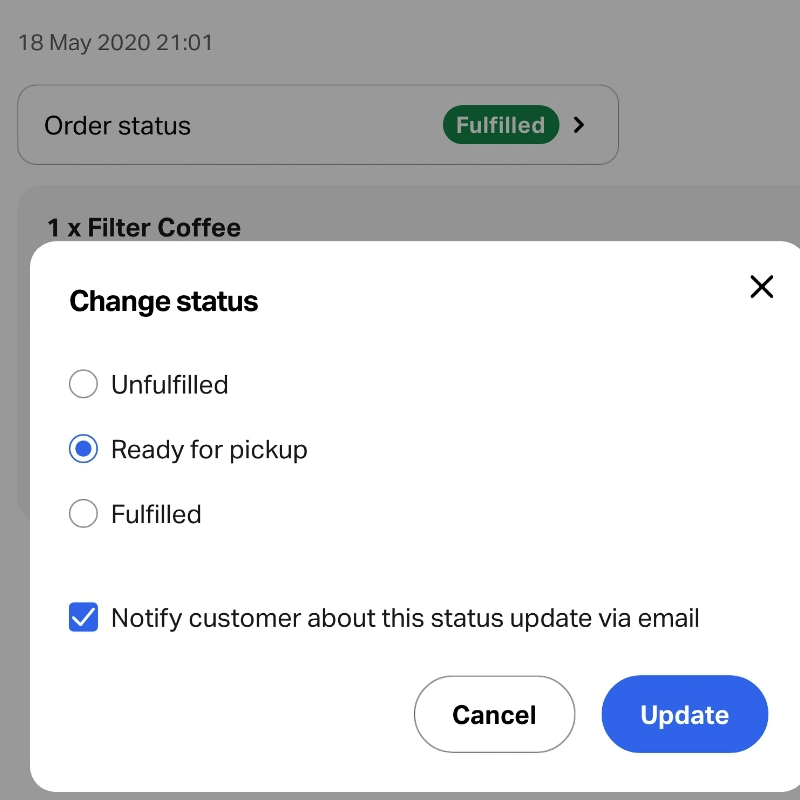

Prototype: Mobile Transaction

Selecting an order status.

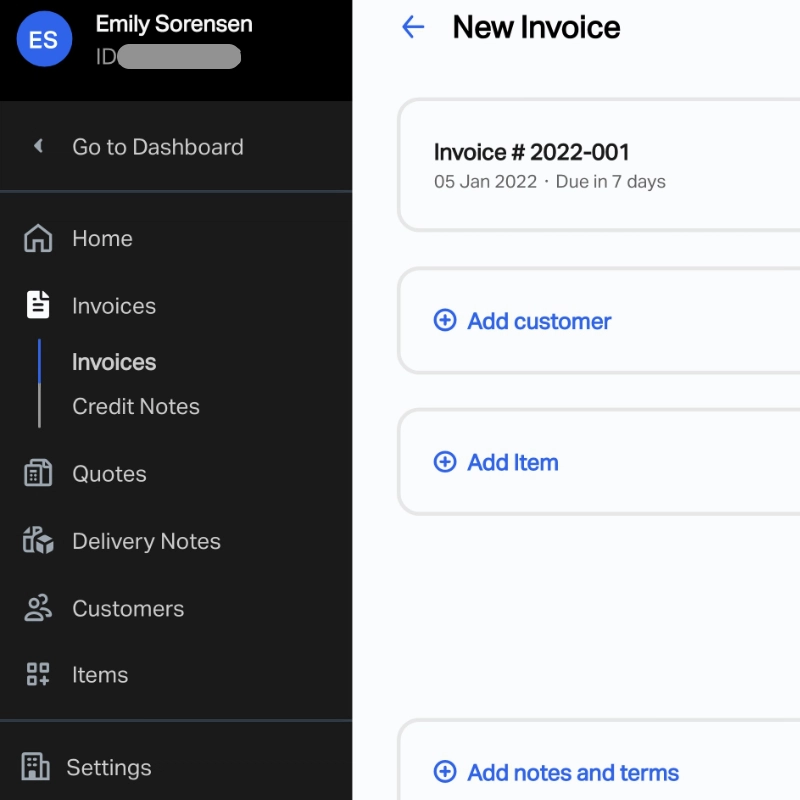

Prototype: Mobile Transaction

SumUp Invoices card in Dashboard.

Alternatively, you lot can transport and manage email invoices from the app or the Dashboard for more features. This includes sending quotes, credit notes and itemised invoices with customer details, and you can generate delivery notes. The recipient tin can pay through a SumUp payment link (fee applies) or make a bank transfer.

What if y'all demand to process a bill of fare payment on behalf of a customer? Eligible users can activate a Virtual Terminal, accessible in both the app and web dashboard. It allows y'all to enter a transaction and carte details, then finalise the payment while talking to the customer over the phone.

SumUp is one of the simply payment companies that permit you to use a virtual terminal from a mobile app. Other providers typically only have a web version to employ on a computer.

Accounting

For reporting options, it's best to log into the SumUp Dashboard in a web browser. Apart from its bones sales overview within a selected time menstruum, yous can export your sales history from a detail day, week or month to a CSV file for bookkeeping.

Payout reports are sent via email when settlements are completed and are downloadable as a PDF file.

Although y'all cannot integrate SumUp with external accounting software, a new SumUp Accounting organization is being rolled out to users in the Dashboard. Here, you can rails all your earnings and expenses, create VAT reports and submit them to HMRC hands.

Photo: ES, Mobile Transaction

SumUp is a convenient choice for beauty salons and small businesses in full general.

Who is SumUp best for?

SumUp suits sole traders, entrepreneurs and small businesses requiring an extremely user-friendly card automobile and versatile features for remote selling besides.

Market stalls, artists and makers, independent shops, taxi drivers, tradesmen, beauty salons, barbers and hairdressers like the straightforwardness of the platform. Many cafés and restaurants also apply SumUp, sometimes with a more advanced POS system.

SumUp is designed to adapt businesses that don't demand more than a few menu readers – anything more, and yous probably want a more than complex POS system that tracks stock levels, staff movements and more.

Y'all can use many SumUp readers in the same business relationship, but the lack of location management can make it hard to monitor who did what.

Outside traders working a lot in the sun should go for either SumUp Air or Solo with its bright, adjustable screen y'all can see in the sun. The display on SumUp 3G is hard to read in strong sunlight.

Photo: ES, Mobile Transaction

SumUp Solo'south screen is visible in stiff sunlight, more then than SumUp 3G Printer.

Those travelling away for business – to merchandise shows, for example – can employ SumUp on their travels if prior arrangements have been fabricated with the customer service team. This arrangement is bachelor for almost all of Europe.

Customer service and user reviews

SumUp'southward online support department volition reply the majority of questions. To contact customer back up, y'all can phone them on weekdays betwixt 8am and 7pm and weekends between 8am and 5pm. To put that into context, the closest competitors, Zettle and Square, but offer weekday support, not Saturdays or Sundays.

Alternatively, you can e'er e-mail SumUp, merely getting a answer can have days, sometimes weeks. We've experienced response times of over a month for non-urgent queries, simply y'all can deal with pressing issues on the phone or through a contact form in your account during working hours.

Users tend to rate SumUp highly compared to several other mobile carte du jour readers, but it is not a perfect service.

For example, people have complained well-nigh lack of back up when they needed information technology. At that place have also been carte reader issues, eastward.g. some users have said their onetime card reader has stopped working for no reason, forcing them to purchase a new terminal after the warranty is upwards.

Photo: ES, Mobile Transaction

The SumUp Air in its charging dock looks great at a till bespeak – here seen in a restaurant.

Sign-up and eligibility

SumUp accepts registered sole traders and businesses with a banking company business relationship owned by the system, business or cocky-employed person. Not-for-profit organisations and private individuals may be accustomed too, provided they meet certain criteria. SumUp can advise farther on this if you lot get in impact.

As with all payment companies, there are certain high-risk business types SumUp will not support, due east.thousand. multi-level marketing, whatsoever kind of adult entertainment, door-to-door sales and unlicensed counselling.

Information technology's very piece of cake to become started: y'all sign up on SumUp's website, submitting bones information about yourself and your business. Like any other payment provider, SumUp performs a check confronting the business details provided.

As long every bit you are not classed as a "restricted business", and your banking concern account name matches your business organisation name, they should accept it all pretty swiftly.

Later sign-up, you tin order a carte du jour terminal on the website, arriving inside three working days. In the meantime, you can download SumUp App on an iOS or Android device and use the available features there.

The virtual terminal can also exist activated for qualifying merchants. Yous demand to contact client back up for this and answer some questions about your concern and payment usage. Subsequently reviewing your account, SumUp may add together the virtual terminal to your dashboard and app.

Our verdict

SumUp is great for depression-volume merchants who just need to start accepting cards, for example in a shop, café, bar, marketplace stall or on the go.

The pay-as-yous-go transaction fee is competitive below a monthly turnover of £5k-£10k. The service has a low bulwark of entry with the cheap, i-off cost of the card machine, no monthly fees and no contract lock-in.

SumUp'south online payment options are super-valuable when y'all need to merchandise remotely, as we have seen during the pandemic. The click and collect features and online store are, however, basic, so eventually you may demand to wait elsewhere to expand these systems.

Furthermore, the SumUp app and payment terminals have just the essentials yous demand without compromising on efficiency and build quality. If you lot do need more POS features, an upgrade to a paid POS arrangement is possible.

Lesser line: With its simple costs, easy sign-upwardly and free extras, SumUp is a solid place to start for a wide multifariousness of businesses.

Share this article

Source: https://www.mobiletransaction.org/sumup-review/

Posted by: jenkinsneard1953.blogspot.com

0 Response to "After Someone Pays Using Sumup Where Does The Money Go ?"

Post a Comment